Blog

Equity Investments Research Thematic Sleeve December 2023

INTRODUCTION

When we think about portfolio construction, specifically equities, we segment our equity allocation into three ‘buckets.’ First, general market exposure, or beta in finance-lingo, which we achieve by buying a low cost index fund typically on the S&P 500 such as SPY. This is generally the largest single equity holding and gives us broad, diversified equity exposure simply by tracking the index.

Second, we hold a portfolio of individual stocks, typically around 10, which we term ‘Core Stocks.’ They are the monopoly businesses and/ or companies the world cannot live without, such as Apple, Microsoft, Berkshire Hathaway, and Costco. While we might be tactical here and there, you can generally expect these to stay constant as we truly want to own these long-term and allow earnings and dividends to compound over time.

Third, is our ‘Thematic Sleeve’, which is an opportunistic allocation to any sector or theme which we believe can add outperformance, or alpha in finance-lingo. Here, we will typically own 3-4 ETFs that first look attractive from a technical, or chart perspective, as this is typically how we approach investing, and second, are attractive from a fundamental perspective, or what positive dynamics are acting as tailwinds for the positions. Below we outline the three current investments we have in the Thematic Sleeve and why we like the fundamental story.

Cybersecurity: First Trust NASDAQ Cybersecurity ETF (CIBR)

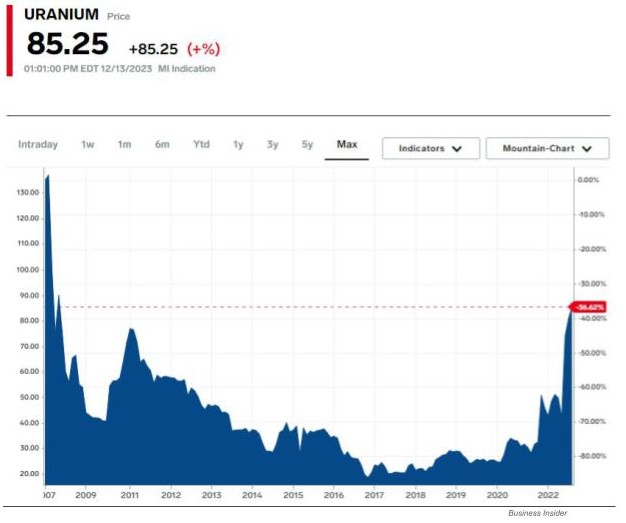

Just this past week we saw another headline break that ‘the Chinese military is ramping up its ability to disrupt key American infrastructure, including power and water utilities as well as communications and transportation systems. Hackers affiliated with China’s People’s Liberation Army have burrowed into the computer systems of about two dozen critical entities over the past year.’ Whether it be China, North Korea, Russia, or any other hostile country or rogue actor, this is a trend that surely will continue in the future. In fact, Total Monetary Damage caused by reported cyber crime, as compiled by the FBI, rose to over $10 billion last year, continuing a nearly parabolic rise over the last 5-6 years.

In 2022, over 422 million people were affected by data compromises (including data breaches, leakage and exposure) in the United States. Per First Trust, the global cybersecurity market is anticipated to grow 10% per year over the next five years and global cybercrime costs are anticipated to grow 15% per year over the next three years. These are big growth rates and provide a huge market for the cybersecurity segment of the technology and industrials sectors. CIBR gives us exposure to companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations. Primary holdings include Palo Alto Networks, Cisco, Broadcom, and CrowdStrike.

Aerospace & Defense: SPDR S&P Aerospace & Defense ETF (XAR)

Continuing on the theme of global instability, Aerospace & Defense is another attractive area of the market. Beginning with Russia’s invasion of Ukraine early last year, now the ongoing Israel-Palestine conflict, and looming spectre of a Chinese invasion of Taiwan, the sector has experienced material tailwinds translating to contractual deals with the US Government. Almost everyday it seems Congress is doling out another weapons aid package to either Ukraine or Israel. Just this week, more than two-thirds of the House voted in favor of a defense policy bill that includes a record $886 billion in annual military spending, up +3% from last year. Unsurprisingly, this seems to be the only topic that receives strong bipartisan support.

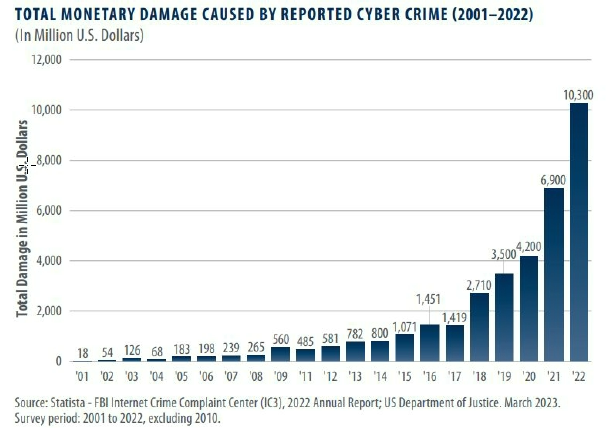

Further, as can be seen on the graph below (by the World Bank), annual US military spending has resumed its upward trend over the last five years or so following the wind down of major combat operations in Iraq and Afghanistan in President Obama’s second term. Given the conflicts mentioned above, we do not foresee our annual budget decreasing on a year-over-year basis anytime soon. Interestingly, on a more micro-level – or stock specific basis – many of the largest defense contractors have not seen anywhere near the same level of stock price appreciation as the Nasdaq or even the S&P 500. For example, year-to-date, Lockheed Martin (LMT) is down -7%, Raytheon (RTX) is down -18%, General Dynamics (GD) is up +1%, and Huntington Ingalls is up +12%. Of course, most have performed quite well as of late.

Similarly, while valuations for technology stocks (and most stocks for that matter) are hitting record levels, the aerospace & defense sector is actually trading at a discount to the broader market. Specifically, the average price-to-earnings ratio of the four defense contractors mentioned above is 17.8x (and 18.5x for the sector as a whole). This compares to 27x for the Nasdaq and 20.4x for the S&P 500 representing a sector discount of 32% and 10%, respectively. Simply put, these stocks are likely still under-owned and the prices as well as valuations appear to have room to move higher.

Uranium: Global X Uranium ETF (URA)

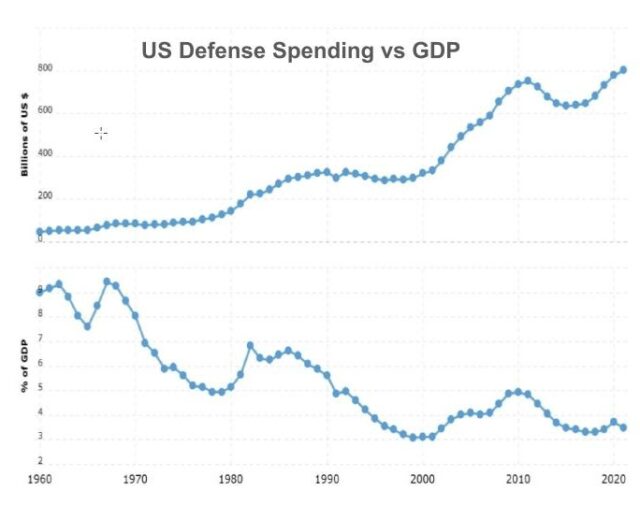

Regardless of what side of the aisle you are on – pro-fossil fuels or pro-renewable alternative energy – one thing is for certain, wind/ solar/ etc are not currently built out or efficient enough in order to be a material substitute to fossil fuels. As such, nuclear is now being seen as a viable clean energy alternative where uranium is the primary commodity input. As Bloomberg reports, leaders in Japan and the US have pushed to support their existing plants and restart dormant facilities to address power strains. Meanwhile, Bloomberg expects Asia to lead in new reactors under construction.

Cameco, the world’s largest publicly traded uranium producer encompassing 13% of the world’s production, recently said on their earnings conference call, ‘all over the world, we’re continuing to see government policies and corporate decisions that are generating positive news flow in support of strong growth for nuclear. Very importantly, those policies and decisions are being followed up with proposals.’ Longer term, the IEA estimates global nuclear capacity needs to double by 2050.

Microsoft even announced this week (as reported by the WSJ) that it is training its generative artificial intelligence to help speed up regulatory approvals for nuclear power. The software giant foresees a massive need for electricity as it pushes deeper into supercomputing and AI. Nuclear is seen as a way to avoid carbon emissions while providing electricity more consistently than renewables can. All of this has led to a dramatic +78% rise in the price of uranium year-to-date, and yet, it is still down some -36% from its 2007 highs (as seen on the chart below). While commodity prices can surely be volatile, the structural tailwinds and now political/regulatory support should continue to drive the need for nuclear, and thus uranium prices higher.