Blog

Fall 2023: Uncharted Territory

Leave the Past Behind

One of the most tempting mental undertakings to find yourself doing during times of great market uncertainty is to look back at history for help in trying to figure out what comes next. We do this too, no doubt. It’s quite comforting to recuse ourselves of the burden of decision making, and abdicate that to the past. This Fall 2023 we recommend if we just find the right analogue from days gone by, one might be tempted to conclude, we can move far more confidently into the future.

Markets have a funny way of giving us a false sense of security, as it turns out. So looking over our shoulders for guidance is not usually beneficial to any large degree, and can also lead to some very damaging mistakes. I know this from personal experience! The past can be instructive and informative, but it should never be used as the sole input to our actions today. I believe the best investors have an ability to parse out the pieces of historical market moves and use them in the right way to make better decisions. Here at Infinium, we try everyday to use the knowledge we have gained in the past 24 years to make better decisions on your behalf. It’s a responsibility we don’t take lightly.

The 1970s seems closest to what we are seeing today, yet this is uncharted territory we find ourselves in. The spike in inflation on the back of printing trillions of dollars to save our economy is a situation we have never experienced, so sorting out what is to come is no easy task. Still, we must try and make sense of the investment landscape before us, and peer into the future to try and figure out what is next.

The J-Powell Hard Stop this Fall 2023

Since Chairman Jerome Powell and the US Federal Reserve did a hard stop and about-face on interest rates last year, the markets have seen some really wild gyrations. We will take a look at this in a moment.

As we have written for the past 18 months or so, there is a big normalization happening right now in a variety of markets – stocks, bonds, cash, real estate, and alternative investments. Although the process has caused the biggest and most sustained drops in prices since the Great Financial Crisis of 2007-09, this is a healthy dynamic, and we welcome it. Sounds counter-intuitive, but from where we sit, the inter-relationship between different investment vehicles is more dependable today than it was back in 2021. Many of you have heard me say this, and it remains true; the current environment plays right into the way we build and manage portfolios.

Magnificent 7 Rule

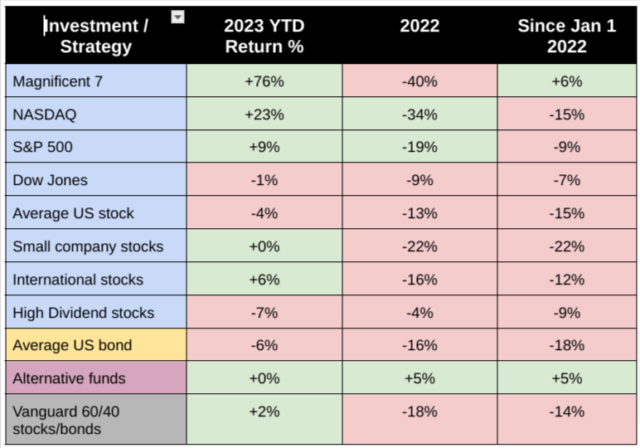

A small collection of the largest of the large US companies have completely dominated the investment landscape in 2023. Affectionately known as ‘The Magnificent 7’ as coined by Michael Hartnett at Bank of America, they have risen a dramatic 76% since the start of 2023.

Too, as the chart below shows, they make up 7 of 503 stocks in the S&P 500 (1.4% of the total), but account for almost 30% of the move of the index. Said another way, these mega-caps, as they are called, have a massive influence on the reported performance of the S&P 500. This is not a problem when a broad group of stocks is participating in the gains (or losses) in any given year.

However, when all the movement happens in the largest stocks in the index, it can give a very misleading view of what the average stock is doing. 2023 will go down as a classic example of a very lopsided year where it pays to look beyond just the reported S&P 500 performance to grasp the true picture of how the stock markets, at least, are performing.

Put on Your ‘MARKET CAP’

Let’s pause for a moment and define ‘market cap,’ as it is referenced several times in this chart, and it’s a really important concept to investing. This is short for ‘market capitalization.’

According to Investopedia:

When we are talking about stocks in terms of Large or Small, for example, what we’re really doing is describing their market capitalization, meaning, the total value of their outstanding shares of stock as traded on the stock exchanges. For a variety of reasons we will not get into here, the big companies have and continue to get bigger, while the rest of the market is not keeping up. A disproportionate amount of investor money is flocking to these fortress companies that investors trust more in times of uncertainty.

Fall 2023: Don’t Get Fooled Again

A deeper dive into the numbers is in order here, so let’s take a look at several periods of time in the recent past to gain some perspective on performance across not only stocks, but other assets we use to build portfolios. We believe it is vitally important to measure performance through a cycle of both up and down markets to get an accurate picture of your risk/reward profile. Simply looking at the rebound of 2023 in some stocks does not tell the whole story:

Some of the important observations:

- Even though the Magnificent 7 are having a monster year in 2023, they are still negative over the past 18 months! This goes to show you just how devastating large losses can be to overall performance.

- NASDAQ returns correspondingly are up quite a bit in 2023, yet have not recaptured the December 2021 high.

- S&P 500 is looking far better than the average stock due to the influence of the Magnificent 7 on its performance, yet the average US stock is down for the year.

- Even though the Dow had the best performance in 2022 on a relative basis, the negative return in 2023 means it has not earned a positive return for investors over the past 20 months.

- Bonds are also in the red for last year and Fall 2023. This is a rare situation and hasn’t happened since the 1970s. Traditionally a safe haven when stocks are down, owning the average US bond has been a real drag to performance for many investors.

- One of the only consistent bright spots on the scoreboard are the Alternative funds that we use. They are up last year and in 2023, on average.

- Finally, the quintessential 60/40 stock-to-bond mix that is considered the overall benchmark for investors is showing a negative return for nearly two years now.

“I Want It NOW!” ~ Veruca Salt, Willy Wonka and the Chocolate Factory

We are all guilty of feeling impatient every now and then, some more than others. And no one, I mean no one, likes to hear the phrase uttered to them, “just be patient.” In the fast-paced lives we find ourselves living, this idea is foreign and not one we readily accept. However, the pursuit of returns on our money calls for accepting that we will not always see green numbers on the screen when we look at our accounts.

When performance is not up, this begs the question, and rightfully so, “Am I not seeing the returns I would like because the markets are just not favorable, or is my investment strategy off?” Sometimes, the answer to this question is far easier to determine than at other times.

Today, unlike the past 10-12 years when the Fed was pumping trillions into the economy, things aren’t going straight up with no volatility. As fun as that time was, it was unsustainable and those excesses must be corrected. I hate to be the spoilsport, but indeed, a country cannot print money to the moon, hand it out to its citizens, and expect there to be no downside.

So the process of righting the ship economically and monetarily is going to come with turbulent times, and it’s our belief that we are in the middle of the process here in Fall 2023. Therefore, the fact that many parts of the markets are showing negative returns over the past 20 months should not surprise the investor who understands the big picture. It’s a natural part of bringing more normalcy back to markets, and for this, we are optimistic.

CDs and Cash, How I Love You So for Fall 2023

Given cash and CDs have beaten most every market out there since the end of 2021, we are seeing a major uptick in the idea of abandoning those areas of the market that have languished (stocks/bonds) for the safety and comfort of cash and/or CDs. “Why would I take all that risk in stocks and bonds when I can outperform it with a risk-free cash account?” Makes sense, right, and who could argue against this? While this may seem like a tempting option at this point, there are many more drawbacks to this approach today than there are benefits.

When you go to cash and CDs, or even certain bonds, you are effectively giving yourself no chance to earn a great return. For many of our clients, the combination of bad, just ok, and great returns is one that results in a number that allows them to achieve your financial goals. Hopefully there are a lot more ‘great return’ years than bad! By removing the great return potential from the equation, you are hamstringing yourself and actually creating greater risk of failure than you are by leaving some risk on the table. Rather than reduce risk in a so-so market, we believe times like this allow for the accumulation of great individual stocks and strategies that provide a superior risk/reward. It’s not often that investors get to buy high-quality at a bargain, and now appears to be one of those times.

Don’t get me wrong; cash can serve a client very, very well in times of market drops particularly. In our summer update, we commented on how we are able to raise cash and have proven we will do so when conditions warrant. However, 2023 is not a year that one would look at and conclude, “ Things are so bad I need to protect my money and take risk down.” Yet, we are hearing this from many of you!

Bad News Sells

An interesting observation that I have seen consistently in my career is when clients are acting and talking as though they are down -20% and they are +/-5%. The disconnect makes you stop and wonder, “Why are people feeling far, far worse than their performance would suggest?” I have my theories, yet I believe it’s quite simple. Not only are investors losing patience given returns are benign right now, but the geopolitical news has been awful.

Bad news sells – period. The news outlets know this and ultimately, they need eyeballs to stay in business. Aunt Martha’s flowers coming up in the spring is an interesting and heartwarming event, yet in the world of digital, all-the-time media, the more dramatic the better. Good news isn’t capturing your attention, sorry Auntie. So let’s keep this in mind as the world unfolds. Not that we should turn a blind eye to geopolitics and the risks that could really hurt us financially, but rather, let’s keep perspective.

You have hired us to keep watch on your precious assets, and we fully intend to stay as vigilant as needed to ensure your goals are met. We are in an enviable position to have a lot of tools to overcome bad markets (Alternatives) and the willingness and ability to make large changes in our mix to protect should a big decline in the markets transpire. So far in Fall 2023, we have seen some decent sized moves up and down, but overall the markets are floating in a neutral territory. Does this warrant running to cash and safety? Not in our opinion. Yet, should conditions deteriorate in a meaningful way, then we’ll take the appropriate actions to reduce risk, just like we did in 2022.

Closing Out the Year – Fall 2023

With the average stock negative for the year, bonds off single digits, and Alternative strategies a mixed bag, it’s been quite ho-hum even though it doesn’t feel that way. This past week has shown us just how quickly the mood can change in this environment of elevated risks. A couple weeks ago, the downturn that started in August was still firmly in place. Yet, the market has done an about face and last week was the first real sustained upward movement since July.

Several of the indicators we watch to help us understand the health of the markets have all of a sudden looked very good. Hence we have been net buyers of stock in the past two weeks vs being net sellers for the prior six weeks. Unless and until some really bad economic data hits, or the geopolitical situations get a lot worse, the trend into Thanksgiving appears up from our vantage point. As I mentioned in our Summer Market Update, we like to see a trend emerge and try to participate in it instead of attempting to outsmart everyone else and time it.

Although the last week was a nice boost and reversal to a multi-week drop in markets, we also acknowledge that there have been a lot of head-fakes this year. In other words, Fall 2023 will go down as a year that a handful of stocks drove all of the performance and investors really could not make up their minds about how much risk they wanted to take. So we are hopeful that a lot of bad news is already in the markets and the current rally is sustainable. But make no mistake, we are not wedded to this idea by any means. Nimble wins in an environment like we are seeing right now and we will continue to make as many adjustments as needed to take advantage of the opportunities we see.

Please be in touch should you like to have a more in-depth conversation about the markets, your financial plan and investments by clicking here:

From the entire team, we hope you all have a great holiday season!