Blog

Market Update | Year Ahead 2024 – Twin Peaks

One of the most perplexing aspects of the markets is their ability to make you feel – how shall we say this – less than smart. Just when you think the data adds up and gives you a clear direction on making investment decisions, seemingly the opposite happens. Think about the millions of folks staring at market screens, running complex computer models, and trying to make sense of it all, only to find that they didn’t come up with the right answers. It’s a truly amazing phenomenon and more in this Market Update.

Year-after-year, we are thrown an endless amount of curve balls and head fakes to try and sift through. Yet, we can’t just quit. In our view, there are more than a few very reliable ways to gain some measure of certainty about where things are headed. In 2024, this Market Update we will take a deep-dive into some of those data points we like to look at in order to understand what may be coming next.

Stocks – Lopsided Like Never Before

But first, let’s reflect back on why 2023 proved just how hard pinning down the markets can be for investors. One of the exercises we go through at the beginning of each year is to try and understand the ‘consensus’ viewpoint. In other words, we want to see just how widespread any prediction is, and what’s the intensity around that idea.

As we discussed in our Market Updates from early 2023, a resounding number of market pundits believed the first half of the year would be tough for stocks, and probably see lower prices, and the second half of the year would be more positive. Specifically, a recession in the first half was nearly a sure thing which would then necessitate the ‘Fed Pivot’ teeing up a strong second half. We would assess that >80% of the talking heads were in agreement with this stance. From where we sit, this was a very unilateral belief shared by far too many for it to come to pass. Through mid-year in 2023, the U.S. stock markets were solidly positive; clearly the financial mob had it wrong yet again.

There was a bigger story in stocks for 2023 that must be told. For the first time in a very long time, just a handful of stocks drove all the returns in the markets. There is a nuance here, and one that bares a few moments of your time to fully understand.

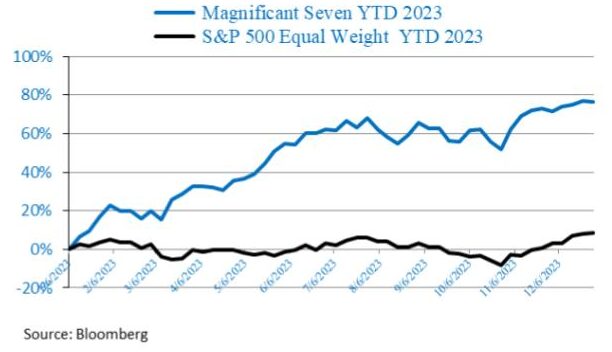

The so called, ‘Magnificent 7’ [Amazon, Apple, Alphabet (Google), Meta (Facebook), Microsoft, Nvidia, and Tesla] appreciated as a collective almost +80%, while the ‘average stock’ as measured by the S&P 500 Equal Weight Index (not market capitalization weighted, so not skewed higher by the mega-cap Magnificent 7) appreciated just under +10%. You can also see from the graph below that all the S&P 500 Equal Weight Index’s return was generated after the fall correction in the last two months of the year.

Putting it all together, the Magnificent 7’s +80% 2023 return combined with the S&P 500 Equal Weight’s +10% return produced a final result of +26% for the S&P 500 Index (market capitalization weighted). So, nearly all the S&P 500’s 2023 return was driven by these 7 stocks. Why did this happen? Hard to say exactly, but probably because market participants saw these as safer than other stocks in a time of so much uncertainty in the first half of 2023.

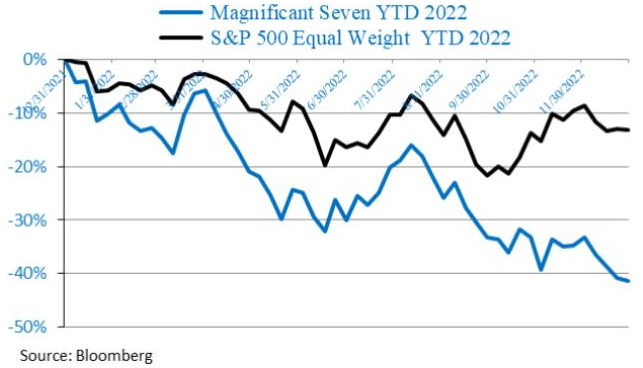

Equally important, is the ‘starting point.’ Recall, the S&P 500 declined a whopping almost -20% in 2022, driven by…wait for it…a greater than -40% decline in the Magnificent 7. Meanwhile, the ‘average stock,’ again as measured by the S&P 500 Equal Weight Index, declined a little more than -10% (as seen in the chart below).

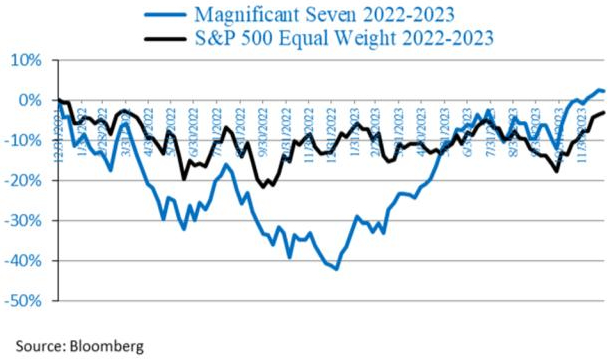

So while the Magnificent 7 had a remarkable 2023, they lost almost half of their value in 2022, and thus just barely eked out a positive +2% return for the combined 2022 and 2023 calendar years (as seen in the next chart below). Similarly, but with less volatility, the ‘average stock’ actually declined around -2% for the combined 2022 and 2023 calendar years. So after the whirlwind of 2022 and 2023, equities are sitting at roughly flat.

Bonds – Your Untrusted Friend

Yet another wild ride for bonds last year. After getting crushed in 2022 for -13% (2021 saw them down -1.7%), US bonds nearly turned in their third losing year in a row. That has never been recorded in modern times! The last time we saw two back-to-back years of negative returns in bonds was 1955-56. So a rarity, to say the least, and enormously detrimental for more conservative investors. The entire year in most bonds was negative through the majority of 2023, and they only turned positive on December 12, finishing with a +2.3% gain plus another +3.3% from the interest payments. Talk about a stick save at the end of the game!

Alternatives – You Can’t Win Them All

After a blockbuster return in 2022, last year was not one to remember for Alternatives by-and-large. This area of investing does tend to struggle when stocks are performing well, and have historically thrived when other markets are struggling. We put an Alternative strategy into our model portfolios only if we anticipate them to return 4-6% no matter what stocks, or other markets, are doing. Unfortunately, Alternatives did not perform up to par in 2023 as a group. In a way, the fact that most of them had a challenging year in 2023 speaks more to the trends in markets being unfavorable versus an error by the investment managers who run them.

Cash/Money Market – The King is Back?

The long since forgotten bucket that we call Cash (money markets) finally gave us a decent return in 2023 (+4.8%), yet when measured against inflation (+5.1%), it was a nearly a wash. Call 2023 a lost year for investors who may have fled to cash, which we saw in March during the regional banking crisis where storied financial institutions First Republic and Silicon Valley Bank failed.

There was a very important lesson learned in early 2023 – when the Fed steps in aggressively to fix something, the markets typically take that as a very positive development. ‘Don’t fight the Fed’ was coined long ago and rings true today. The past +20 years since the Tech Bubble of the late 90s has shown us time and time again, sometimes the scariest times create incredible opportunities to profit when Uncle Sam has your back. We fully expect this mantra to continue to hold true once the next major event hits.

Outlook for 2024 – Bet Against the Crowd, Again!

It seems obligatory in this Market Update to offer a window into the next 12 months at the beginning of each year, yet, as many of you know, we really do focus on getting the next major move correct, rather than look too far down the road. Part of the problem in making a forecast on the markets is the fact that so many factors play into prices. I love the Warren Buffet quote that helps us to understand the great mystery of investing:

“In the Short-Run, the Market Is a Voting Machine, But in the Long-Run, the Market Is a Weighing Machine”

What can we say about the coming year? What is the setup going into 2024? Unlike 2023 where the consensus was squarely negative (and really wrong), today there are a lot more Bulls out there than Bears. However, it’s not nearly as intense of an outlook as last year. In other words, we believe there is too much optimism right now, yet it’s not enough for us to be overly concerned.

Stocks – Twin Peaks

On the downside, when we look at our instrument panel of indicators in this Market Update that give us a read on their health, the data are suggesting the circumstances are in place for the next major move lower in the markets. Has a major drop happened yet? Clearly that answer is ‘no’ for the time being. But, we are at a very important inflection point in the overall market right now. We have ’round tripped it’ and returned to the high from the end of 2021, in essence, we have made a twin peak. The pause we are seeing right now is not unexpected, but it will take a lot of good news to push us through and keep from slipping further backwards.

So, we find ourselves in a spot where conditions support taking a more cautious approach in portfolios, but you have to leave room for a danger signal to be wrong and the market to advance higher from here. For our model portfolios, we have been generally reducing risk and raising cash levels over the past 1-2 weeks and will continue to do so if conditions deteriorate. In our view, we will know in the next 2-4 weeks if the rally can continue or we are headed for steeper losses in Q1.

Bonds – Still Not Your Friend

The bond markets have given up recent gains as well. As we mentioned above, bonds have done very well since about late October as interest rates fell in Q4 of last year. Now the situation is quite different – rates are on the rise again and the average bond has shed -1% in just a week’s time. This might not seem like a lot, but it is for the bond market.

So how do you make sense of bonds today? Keep the seat belt fastened! We fully expect the volatility in bonds to continue as the Fed tries to reduce its ownership of bonds and markets deal with all of that extra inventory floating around. Here, too, we will delve deeper into this concept this year and try to help you understand this very important part of the markets, and your portfolios.

Our overall take on bonds is to be much lighter than you normally would, as we have just come off of a 40-year bull market in fixed income. The last part of the multi-decade run in great performance in bonds was orchestrated by the Fed and their artificially pushing down interest rates. It’s a classic case of man and woman interfering with natural market forces to try and engineer a better outcome. As the saying goes, “Mother Nature always wins,” and this time should be no different. We remain negative on bonds, but also acknowledge that investors will probably get opportunities to buy or sell them to generate returns versus just sitting on them in your portfolio.

Alternatives – Love ‘Em and Leave ‘Em

We love this area of the markets when everything else is going down in value. Managed Futures, in particular, just have not delivered to our liking when prices are moving up. So we fully intend on being more active in this part of portfolios in 2024. I really wish we could put 10-20% of a portfolio into Alternatives and let it ride, but we do not have that luxury. Maybe this changes and we will just have to watch how the performance transpires, especially in good markets with rising prices. With extra cash on-hand right now, we may be bumping up the allocation to Alternatives in Q1 should they start to put some nice positive returns on the scoreboard.

Cash/Money Market – Keep Up the Good Work

We like being cash-heavy to start the year. Although interest rates on money markets are down from the peak in the fall the current yield is still above +5%, so we are actually still seeing a decent return by holding cash in the short-term. Again, cash is a tactical tool for us overall, except for our most conservative investors.

Unlike the ‘free money era’ where the Fed had interest rates near zero, there is not a huge drag to performance in cash, and this is a good thing. Yet, short-term bond and cash instruments should technically limit gains in the riskier assets – like stocks – since they are competition now. 2023 would not support that conclusion, however, as stocks did just fine with +4-5% money markets. Chalk this up to an outcome that one would not expect, but it happened. In 2024, will cash win the race, or limit riskier asset gains?

If we could only peer ahead for a moment and know for sure! Cash will remain a very important tool for us to reduce risk and wait for better prices when markets are falling, and we fully expect that there will be more than a few periods of time this year when we have cash abnormally high.

Final Thoughts – No Time to Rest

As strange as it sounds, down markets are very beneficial for how we manage portfolios because we are not afraid to sell and raise cash when conditions tell us to do so. If an investor can preserve value in cash while prices fall, the next challenge is to re-deploy that cash back into riskier assets. This process is not to be confused with ‘market timing!” The former is reacting to the signals you pick up, and the latter refers to trying to outsmart everyone else and guess right. You don’t have to be first to react to major market moves, just don’t be last! Hopefully, we are able to pick up those 2-4 tradeable moves that might come our way in 2024.

As always, please click this link to schedule time with us to discuss your portfolio, or just to say Hi!