Blog

The Song Remains the Same

The Song Remains the Same

If you were tempted to undo your market seatbelt as we entered 2024, that has turned out to be a bad idea. The wild ride has continued here in February, seemingly across many finance markets now, not just in stocks. In a sense, the song remains the same even though we have seen glimpses of a greater return to a more normal trading pattern.

Spend Baby, Spend!

In order to understand where we are today, one must always look back to where we just arrived from to gain the best perspective. The era of big government intervention in the markets can be traced to the turn of the century when the Tech Bubble 1.0 was in full swing. At that time, investors made a huge mistake in allocating enormous amounts of capital to companies that were not going to last. They merely had the words ‘net or web in their names, and up, up and away went their stock price. It took more than 15 years for the tech-heavy NASDAQ index to recover from its -74% drop during those years. My, how we can forget!

From the early 2000s up until 2022 or so, the US Federal Reserve pumped massive amounts of money into the economy in order to support economic growth and prevent deflation. That’s right folks, for the better part of two decades, they increased the money supply 600% and really saw no negative impacts. Back in 2000, the federal debt in the US was a mere $5 trillion. Fast forward to today and we are seeing an acceleration of the debt load, that now sits at more than $34 trillion! Sadly, a pittance of this spending went to good use, such as into our crumbling infrastructure. Instead, we subsidized a red-hot housing market for middle-to-upper class citizens (leaving the lower middle class out), and handed out free money to people most recently during the COVID lockdowns. Not exactly prudent stewards of our nation’s finances to say the least.

The Great Reset

My, how the landscape can change suddenly. Today, the Fed is on a major crusade to tame inflation and put that genie back in the bottle. Good luck with that after a two-decade+ debt binge!

The CPI reading this week gave the markets a glimpse of just how hard an effort this is turning out to be for the Fed. Which brings us to a very important difference in our view at Infinium vs the consensus view: we believe the odds the Fed lowers short-term interest rates six times in 2024 is a very remote possibility. In fact, we would be surprised to see more than 3-4 cuts. The set up, therefore, is one of significant disappointment, and probably lower prices in stocks and bonds.

We also believe the pick up in market swings is a direct result of investors trying to deal with this sea change of higher interest rates and inflation. We haven’t really seen this in more than 50 years, so it’s no wonder that one day prices are up, and the next they seem to fall out of bed. It doesn’t make our job easier, that’s for sure. In a way, investors became very comfortable with and reliant on lower and lower interest rates and Fed support, now it’s just the opposite. This dynamic, as much as it has created uncertainty, also creates opportunities, in our view.

Status Check: Stocks on Pace for +80% in 2024!

So far, stocks have stabilized after a drop right at the start of the year. Recall we were seeing many signs this would happen, yet prices only gave up a little before resuming a climb higher. We did not expect things to hold up, which speaks to the idea we discussed in our Year Ahead commentary that these markets love to do just the opposite of what you think they should do.

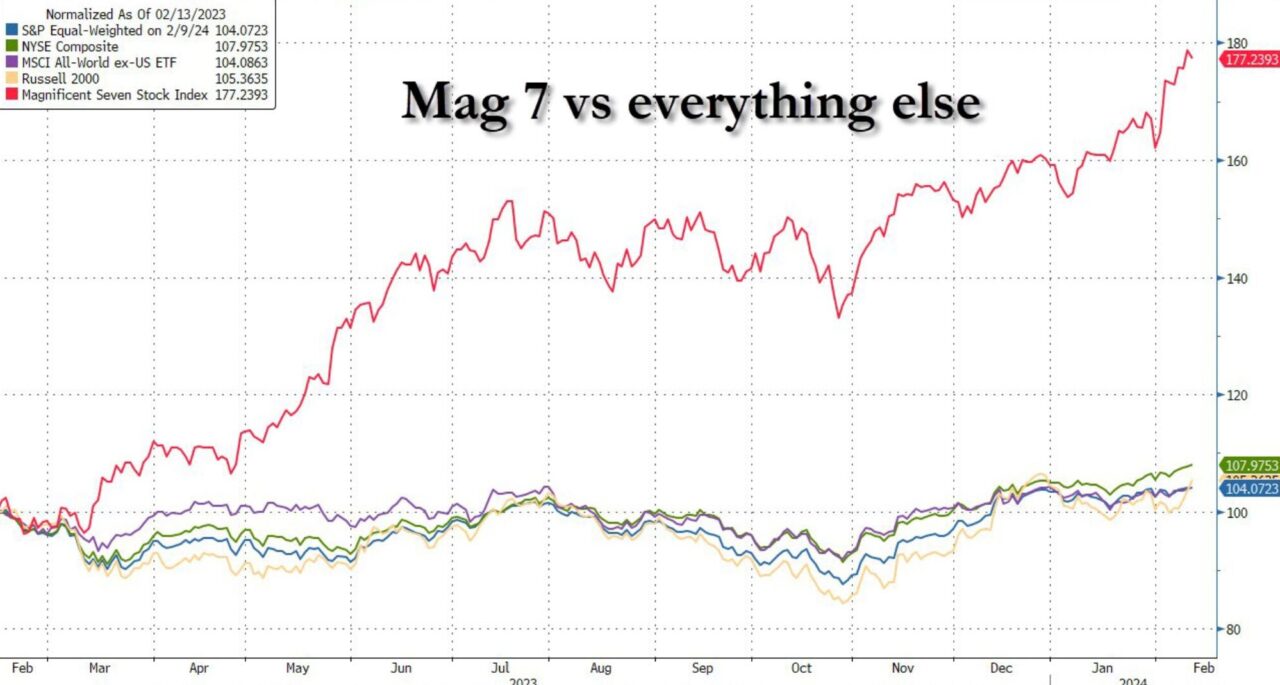

Too, stocks are proving our theme that the current trends remain firmly in place. There is a major skew among winners and losers in the market today. Those overly-loved Tech giants continue to steam ahead to levels that leave even the most optimistic investors scratching their heads (+7.2%), while the average stock is up a mere 0.5%. The Dow is up about +2%, and the now Tech-heavy S&P 500 is +5.3%.

If we take the rate-of-return over the past 45 days and extrapolate it to the end of 2024, you would be up nearly 80%! I write this to provide you a perspective on the first 45 days of the year. We are not betting this level of appreciation is sustainable, in fact, some of our indicators are back to flashing red after cooling off at the end of January.

A final note on stocks. We highlighted the term ‘Magnificent 7’ (Amazon, Apple, NVIDIA, Alphabet (Google), Microsoft, Meta (Facebook), Tesla) in some previous Market Updates. Investors continue to crowd into just a handful of stocks like this, as this basket is now up more than +10% YTD. Again, things can always go on far longer than we might want to believe, yet, we are doubtful these 7 stocks are the leaders by the end of the year.

Bye Bye Bonds

Most of the bond market continues to struggle here in 2024, with the average down more than -2%. Longer-dated bonds, those that mature in more than 20 years, are off an breathtaking -6.1%! This is not good for the average investor, as the standard model that many investors subscribe to is a 60/40 split between stocks and bonds. Fortunately here at Infinium, we are not beholden to corporate mandate or static models that dictate a certain % in bonds. So for now, we remain squarely light in our allocation to this area.

Alternatives Come Alive

The turnaround story of the year so far is in the Alternative space. Since the current market rally began in late October last year, this area of our portfolios has struggled until very recently. As we mentioned in January, our goal is to see a positive 4-6% in the Alternatives no matter what is happening in the rest of the market. The downside protection has been great, as evidenced by the strong returns in 2022. 2023 was a treading water year and now in the past month we have seen a nice gain in the 3-5% range for our investments here. Markets are fickle, and most of the strategies here have had a hard time, so the weakness in the past six months is more situational from where we sit, than a problem specific to any one manager, for example. Overall, we are looking to get our mix back up Alternatives if we see the positive returns continue.

That’s all for now, as always, please let us know if you want to chat on any topic broadly or to your personal situation by clicking HERE or the Schedule Call button above.