Blog

Market Update June 2024: Sold Down the River

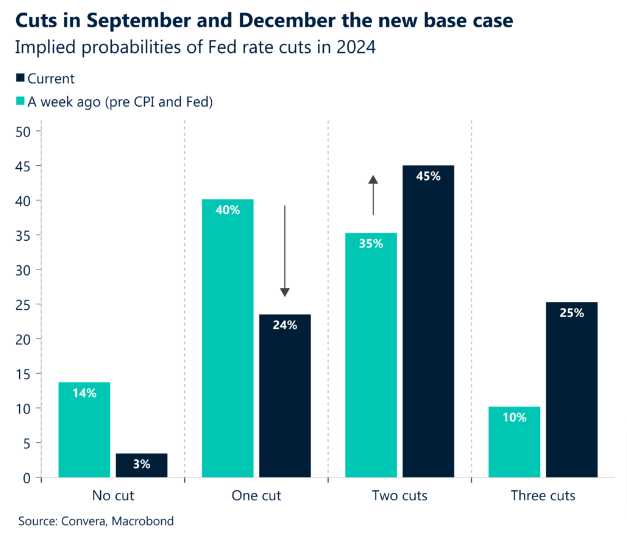

If you were tuned into the financial talking heads at the very beginning of the year (Market Update: Year Ahead 2024), the big focus was on estimating how many times the US Federal Reserve would cut interest rates in 2024. The odds said six times, and some folks even thought seven was in order, maybe more. They reasoned that the massive increase in interest rates over the past two years was enough to not only kill the inflation in the system, but that the high rates meant the economy would get into recession territory. This was a very logical way to try and understand the current environment, and maybe where things would be headed in the year ahead.

But, like we have seen so many times over the past two decades, applying logic to the markets can be a really, really bad idea. Strange as it sounds, there is quite a large disconnect between what we believe the future will look like in the markets, and what actually happens. This dynamic is what keeps investment folks like us, nice and humble.

We have written about this before, and it continues to remain true; never let your rational reasoning get in the way of doing the right thing for your portfolio. In other words, you are free to believe any narrative you would like, just be ready to do just the opposite of what you think you should do.

Fighting our feelings is one of the hardest things to do in investing, if you want to be successful at it. This mindset takes time to develop, because it defies logic. Yet, if you want to profit in the markets, you must be able to fight your instincts (at times) and see the world for what it is.

State-of-the-Game Today

The current reality is an all-time high in some of the US stock markets, and bonds starting to look a lot better. The Alternatives in our portfolios have languished in the past month or so, after having far exceeded our expectations for the the first five months of the year. Residential Real Estate continues to be a dicey place, filled with a lot of uncertainty and record-low sales volumes. Commercial Real Estate is in an all-out ragging bear market in many parts of the country. And on top of all of this, we have an unprecedented political landscape in front of us and and this little thing called a Presidential election a mere five months away. So overall, we have a very mixed bag of circumstances in the markets we watch closely.

Outlook for the Rest of 2024

Given the surprising strength of the US stock market year-to-date, we expect investment managers to chase stocks higher into the close of the quarter over the next two weeks. They are behind in performance, yet again, and must dress up their portfolios with the recent winners to make it look they have been in the right spots all along. This is a sad reality, but it does create opportunities, if you know how the game is played.

We have several data points that we watch in order to help us understand where the market is headed in the short-term (weeks) to intermediate-term (months). Certainly these are not always reliable and will not be useful at all times. But, when they hit extreme levels, you do tend to see a reversal in a trend. That’s what we look for in the data we watch, and ask ourselves, “is this trend too strong and going to flip the other way?”

Currently, we have an extremely high level of bullishness among professional money managers. This always coincides with a top in the market. It doesn’t mean a big drop is imminent. But rather, the uptrend is about out of steam. The magnitude of any move in the markets is the hardest thing to predict, but the direction, or likely direction, is not, if you know what to watch. Advisor Sentiment is a key input for us, and seeing it too high will cause us to reduce risk sooner than later when the markets start to deteriorate. We anticipate this is far more likely to happen sometime in July or August than in the next two weeks before the end of the quarter, per my comment above.

Other data points are not this extreme, so that is partly the reason why we believe the current rally that started in April might still have some legs for the very near term. It’s an interesting dichotomy right now, and overall.

Finally, we are putting the finishing touches on an important software upgrade for the firm and you. We have been working feverishly for the past two months to transition away from the Orion system to a new one called Advyzon. We have piloted the software ourselves and with several clients, and the feedback so far is very positive. From our perspective, the toolset is exponentially better, easier to use, faster, and allows us to run the practice hyper-efficiently. Not bad, right?

The client experience is industry-leading and we will even have our own app on the Apple and Google platforms. Until that is officially released (we expect in July), you will access the system through a desktop computer, so please look for an email soon with all of the details.

Admittedly, we have had two major focuses this year – performance in portfolios and the systems upgrade. We are looking forward to a steady-state there which will allow us more time to be in touch and review your portfolio and financial plan. Thanks for your patience and be on the lookout for additional communications from us on the software changes.

Have a fun and safe summer!