Blog

Market Update May 2024 | The Golden Oldies

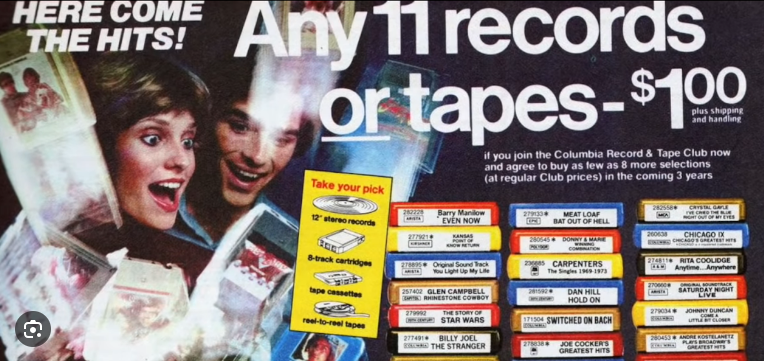

Remember those Columbia House ads from the 1970s and 1980s giving you an opportunity to build out your record or tape collection for just a buck? Talk about a teaser rate! I seem to recall that after you received the 11 albums, the price went to something like $12.99 per unit! Hardly a bargain, but how many people bit on that ‘too-good-to-be-true’ offer up front? Many did – including yours truly.

Metals Making $$$

It’s funny how we see these themes from yester-year coming full circle in the markets today. One of the best trades through Q1 and April has been gold and precious metals, like silver. Notwithstanding the recent drop, investors are warming up to the idea that traditional currencies – like the US Dollar, the Japanese yen, and the Euro – have major issues. Sadly, here in the US, we have gone so far as to abuse our position as the most sought after currency in the world. As a result, nations are making big strides in moving away from the Dollar and into other places to conduct business. This is a sea-change to the world’s economic landscape, and one every investor should be taking very seriously. We are.

Alternatives Continue to Win

More on this in a bit. As a result of big moves in the metals, and other commodities, the Alternative investments we use have benefited handsomely. They are off to an incredibly good start four months into the year, which is quite different from the past 10-12 years in up markets. The most frustrating part to owning these after the Great Financial Crisis of 2007-09 was that, in good stock markets, they really lagged. This should not have been the case, yet it was. Today, we are seeing nice, positive performance with the stock market also doing well. This is a welcomed change, to say the least.

Status Check: Stocks flat since early February

In the stock market year-to-date, we have seen a volatile ride. Returns were double digits at the end of Q1, and April hasn’t treated investors well at all. Most of the US stock markets lost about -4% this past month, and now sit positive about the equivalent amount: Dow +0.6%, S&P 500 +5.3% and NASDAQ +4.0%.

As we have noted before these indexes are constructed in a way that usually favors the larger companies, so they don’t represent the ‘average’ stock. We have highlighted how this can really skew the view of what is going on across the board. Lately, the smaller companies have done better than their large brethren, keeping the disparity to a minimum. The average US stock is up a measly +1.8% YTD.

Bye Bye Bonds

Yet again, the markets have dealt bond investors a bad hand so far in 2024. The average bond is down more than -4% YTD. Although the interest rate is up from recent years (3.28% annually) the payments from these bonds have not offset the principal losses in the bonds in any meaningful way.

In a recent dinner event, we reflected on the fact that most investment advisors are forced to invest their clients in standard models that always include bonds. Sometimes, a lot of bonds! While we feel for the clients who bare the brunt of a really bad bond market, we at Infinium see this as a very important advantage we have in the marketplace – to avoid bonds that are subject to these kinds of losses. We have no corporate mandates that force us to do anything, and we are very much underweight in this investment bucket.

Outlook: Not my President

I have worked in the financial services industry for more than 25 years, and have witnessed the dynamics of six presidential elections. The one overriding theme during these times – which should come as no surprise – is that investors hit the ‘WAIT’ button en masse. They are adamant about ‘not doing anything until after the election.’

Although there seems to be merit to this – why step in front of a lot of uncertainty? I would argue that there is virtually no political risk in the US. The media would have you believe otherwise, clearly. Yet, the exchange of power happens, and it is far more likely to go off without a hitch than not. Even with the riots in D.C. the last time, we are not overly concerned about a major market disruption due to the folks who won’t like the outcome. And let’s face it, about ½ the country will collectively barf when the winner is announced. They won’t be happy is the only guarantee at that time.

From a markets perspective, you might see certain areas of the industries and sectors do better (or worse) depending on who wins, but normally this is not very tradeable, in our view. So sit back, watch the fireworks, and if anything, get your shopping list ready for late summer when investors have sold off great stocks or strategies and you can pick them up at a bargain. That’s our game plan today.