Blog

May 2025 Market Update: Looking for a Winner

Having just celebrated my 26th year as a financial advisor, I couldn’t help but reflect on just how much life, and the markets, have changed over the past quarter century. I’m not sure anyone could have anticipated the twists and turns we have had to navigate, yet that’s precisely what makes it such a captivating challenge.

Three Important Developments in Personal Financial Services

I remember back when I started at Merrill Lynch in 1999, the entire industry was trying to understand how this new communication tool called the internet was going to affect our work as financial advisors. Little did they know! Not only was there an effort to understand this new technology, but there was an aura of fear in the air as well.

1) Democratization of Information

Prior to the internet, financial information was housed in protected silos within investment companies. This was their secret sauce and they charged handsomely for it. You can imagine the concern up and down the organization when leadership decided to make all of Merrill Lynch’s proprietary investment research available online for free. More than a few arguments followed. In retrospect, this was the right direction to take given the exponential growth in accessibility of information and data.

What they couldn’t see back then was that the pendulum was about to swing to the far other end; information overload was the new problem that savvy financial advisors could solve for their clients.

2) Greater access to markets

Since the late 1990s, investors have gained unprecedented access to financial markets, driven by technological advancements and regulatory shifts. The rise of online brokerages democratized trading, enabling retail investors to buy and sell stocks with low commissions from home computers.

Regulatory changes, such as the SEC’s Regulation ATS (1998), fostered electronic trading systems, increasing market transparency and competition. The smart and forward-thinking investment companies looked at these changes as opportunities, while those that took a defensive posture, and continued to run business as usual, saw their relevance diminish considerably.

3) Lower fees

25 years ago, investors benefited from significantly lower fees, driven by technological innovation and fierce competition in the financial industry. Trading stocks often incurred high commissions, with full-service brokers charging $50–$100 per trade. The emergence of online brokerages slashed fees to $10–$20 per trade, and by the 2010s, platforms introduced commission-free trading, forcing competitors like Charles Schwab and Fidelity to follow suit. Mutual fund expense ratios also dropped, from an average of 1.5% in the 1990s to under 0.5% for many index funds by 2025. The rise of ETFs, with fees as low as 0.03%, further reduced costs for diversified investing. These lower fees have boosted returns, enabling retail investors to keep more of their wealth.

The Markets Year-to-Date

Now that we have taken the trip down Memory Lane, let’s turn our attention to 2025. Clearly, with the new administration taking office in January, we have seen an uptick in our clients’ concern over what lies ahead. Some are as enthusiastic as they can get, while others are downright in despair. No matter which way you feel about the political environment, know that it’s not our job to believe any story unless and until we see it happening. This is a very important distinction.

The U.S. financial markets in 2025 have experienced significant volatility, clearly driven by President Trump’s aggressive trade policies and tariff implementations during his second term. The year began with optimism, as the S&P 500 had gained over +23% in 2024, following a robust +24% rise in 2023, marking its first two-year stretch of +20% returns since the late 1990s.

However, this momentum reversed sharply after Trump’s April 2, 2025 “Liberation Day” announcement of sweeping tariffs, which triggered widespread panic selling and the largest global market decline since the 2020 COVID-19 crash. The S&P 500 fell more than -15% at the bottom on April 7, while the Nasdaq Composite plunged nearly -25%. The Dow Jones Industrial Average also saw steep losses, shedding over 4,000 points in early April alone.

Score It

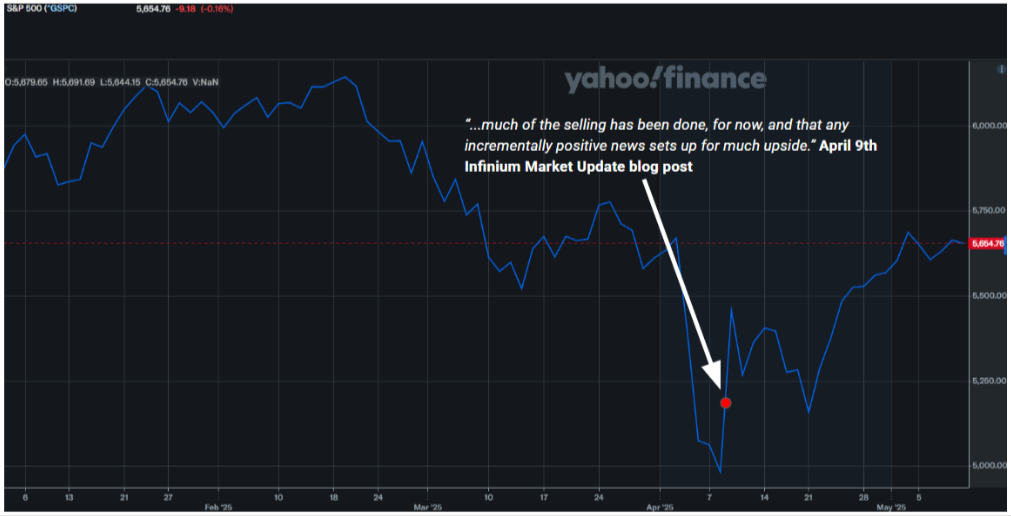

Recall our April 9th, 2025 Market Update blog post High & Dry that we strongly believed the markets had oversold, and there was far more upside than downside in store from that point.

Since we expressed this opinion, the S&P 500 is up more than +13%, so it’s time for a victory lap, but we promise not to injure our elbow patting ourselves on the back too much. There’s still a lot of time left in the year, and our work is far from over.

So far in 2025, all major US indexes are in the red. The Dow is the best performer of the US markets at -3%, the S&P 500 is -3.8%, and the NASDAQ is the worst performer YTD at -7.2%. Bonds are barely positive at +0.9%. It looks like today is going to be a whopper of a bump higher with hopes of a trade deal with China in store, so these figures are going to look even better soon.

Sector performance is mixed. Technology, previously buoyed by AI-driven gains, faced headwinds, with the Nasdaq rising just +0.9% in April due to export restrictions on chips to China, impacting firms like Nvidia. Energy plummeted -13.9% as oil prices dropped -20%, with Brent crude falling to $66.13 per barrel. Health care also struggled, declining -3.8%. Conversely, gold (+27%) and commodities (+8.9%) have surged as safe-haven assets amid uncertainty and the brewing currency/debt issues the US faces.

Gold has been a core holding of ours since the Covid crisis in 2020, and we have written frequently about it ever since. For many client portfolios, it is their top-performing asset in 2025, after notching a nearly +30% year in 2024. We continue to believe tailwinds will keep Gold strong, yet we are well aware that sentiment can change very quickly on an asset when it’s done so well.

In 2025, Bitcoin experienced significant volatility, peaking at $109,026 in January but dropping -11.7% in Q1, its worst first quarter since 2015. Despite tariff policy uncertainty and profit-taking, it rebounded to $103,146 by May, driven by institutional adoption, ETF inflows, and post-halving dynamics. For some client portfolios, we have added a bitcoin holding back into the mix after having held it briefly at the end of 2024. So far, so good, in this nascent corner of the markets.

Remainder of 2025

A wise investment professional once said,”To be a successful investor, you don’t need to think too far ahead; get the next big move correct, and worry about what happens after that.” Sounds simple, yet in practice, it’s hard to do. The beauty of the sell-off from earlier this year was that the sentiment around the markets had gotten so low, there was really only one place for it to go, and that was up.

Today, investor sentiment has done a full 180 degree shift, and now they are actually decidedly positive. For all of those folks who sold when things were weak, did any of them buy back in at the lows? We all know the answer to this; it’s not hard to get the sell correct, but very difficult to get back in.

In order to move higher from here, the stock markets need a breather, which they are getting. Too, the continued good news on trade deals will certainly add to investor optimism, which we fully expect.

We still maintain that many investors are horribly under-invested and holding too much cash. As long as no perceived really bad news hits the markets, the upward trend we find ourselves in seems to be the path of least resistance. Markets don’t move in a straight line, so we don’t expect a grind higher to happen without a continued roller coaster ride. Hold on, and keep your seat belts fastened, please.

Final Thoughts: Thank You!

With all of the change in the financial landscape over the past quarter century that I have been a financial advisor, one thing that hasn’t changed is the passion I feel for this career and being your partner through the journey.

Have a safe and enjoyable summer and we look forward to speaking with you soon.