Blog

IRA Hack: Rule 72(t) Might Help You Avoid the Early Withdrawal Penalty

Among the strengths of an Individual Retirement Account (IRA) are the incentives to save for retirement–but also the disincentives (penalties) that discourage premature withdrawal of funds. Long-term saving that begins early in life is powerful. Legislation that created the IRA in 1974 and kept modifying it, especially to widen eligibility, took care to weight the incentives toward the long term.

So what about rule 72(t)—IRS code 72(t), section 2—that specifies some exemptions to the rules penalizing early withdrawal? And also applies to 401(k) and 403 (b) plans with private employers. Its intention is to recognize special circumstances in which an individual may be justified in making early withdrawals from an IRA—and so allows those withdrawals without the usual penalty.

In our more than +20 years serving our clients, we have helped just a handful of individuals use this uncommon rule. And it makes sense – these accounts are earmarked for retirement, so tapping them early should only be considered in light of an overall financial plan, and the risks that it creates. Namely, if you are breaking into your retirement accounts before you are retired, do you really have enough assets to sustain yourself in retirement? Only a detailed plan of action and thorough analysis can answer this question.

Brief background on IRA

First, just a bit of background. Almost anyone today can open an IRA and annually “contribute” to it from earned income up to certain limits. The income thus contributed will not be taxed that year by the IRS. Nor will the capital gains or dividends earned by the IRA over decades be taxed. It is a kind of laissez faire economy intended to give wealth building free rein.

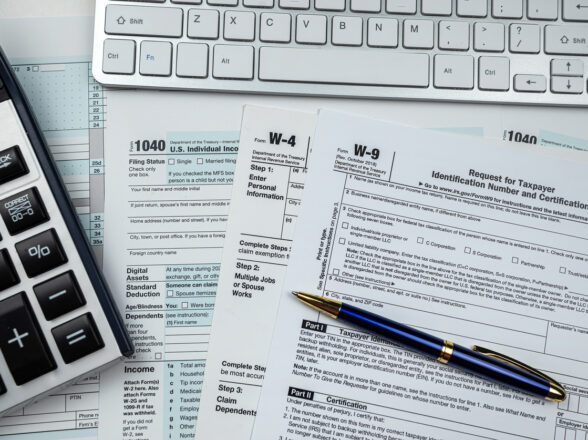

All withdrawals from an IRA are taxed. If withdrawals are made after your age 59½, they are not hit with an additional 10% penalty for withdrawal, but they are taxed. This adds to the benefits already discussed. When you retire, at whatever age, your other sources of income should be reduced, so your income from your IRA withdrawals are taxed in a lower tax bracket.

Against this backdrop of tax-advantaged contributions, growth, and withdrawal, Congress has conceded certain justifications for early withdrawal of IRA funds and eliminated the 10% penalty (but not the income tax). The same exemptions are given to 401(k) and 403(b) plans with an employer.

A crucial “take-away,” here, is that withdrawals under 72(t) are viewed as the IRA holder’s rescue of last resort. Why? Because other IRA rules already permit penalty free withdrawals to meet exceptional medical expenses, to aid in purchase of a first home, and other reasons.

When 72(t) may become relevant

It is when these other IRA early withdrawal exemptions don’t apply that 72(t) may become relevant. Therefore, the justification of the withdrawal is not defined by a specific financial pressure on the IRA holder, but is left to the IRA holder’s discretion.

In these circumstance, what the IRS requires for penalty free withdrawal is a certain amount and pace of withdrawal of IRA funds. The restrictions are intended to protect the IRA holder’s retirement savings as much as possible, especially by eliminating large, one-time withdrawals. The chief requirement to qualify for penalty free withdrawals from your IRA is meeting the SEPP (substantial equal periodic payments) regulations. This requires that the holder of the IRA–or 401(k) or 403 (b)—be willing to take at least five substantially equal payments, the size of which is calculated by one of three IRS-approved methods. The bottom line is that the payments must be based upon the IRA holder’s life expectancy. They must occur over five years. Or occur until the IRA owner reaches age 59½.

The IRS has gone to some trouble, it must be conceded, to give IRA holders flexibility in calculating the size of these payments. All are based upon projected life-expectancy, but by one of three IRS-stipulated methods:

- The amortization method sets yearly payments by amortizing the balance of an IRA owner’s account over a single or joint lifetime. It tends to arrive at the largest possible amounts that can be withdrawn.

- The minimum distribution method is another IRS formula for dividing the retirement account balance; it tends to arrive at the smallest possible amounts that can be withdrawn.

- The annuitization method is another IRS formula that tends to give the IRA holder payments between the maximum and minimum provided by the other two methods.

As you consider a 72(t) withdrawal, it is crucial to realize that this is viewed as a last resort. Other IRS exceptions are provided if you have requirements like disability or illness. When your financial pressures do not involve these or other specified circumstances, and you have exhausted such avenues as loans, credit negotiations, and bankruptcy, it is time to look to 72(t).

The fact that you have set up an IRA and contributed to it, building up a balance, means you are on track for adequate retirement savings. That means that you may be better prepared for retirement than some half of American households, which the Center for Retirement Research deems “at risk” of not having enough money to maintain their current living standards in retirement.

Early withdrawals from your IRA, 401(k), or 403(b) retirement savings plan could jeopardize the strategy you have launched for avoiding the retirement risk of many other Americans.

Infinium Investment Advisors

Changing IRS rules, as well as technical issues such as 72(t)–and so many changes that affect saving, investing, and retirement–require finding a financial advisor that you can trust. You want an advisor who can add value to what you already understand and have achieved.

At Infinium Investment Advisors, LLC, our team has a history of progressive thinking and solutions that are client-centered. That means we are ready to get a grasp of what is most important to your plans, your life, and then to work with you in the long-term, informed, and consistent way required to get where you want to go. Please be in touch HERE if you would like to chat on your most pressing needs.