Blog

SEC warn Investors on Self Directed IRA perils

What is a self-directed IRA?

Self-directed IRAs offer investors the ability to diversify their investments with a broader portfolio of assets than other types of IRAs, however the SEC is offering a warning. Those assets may include real estate, private placement securities, precious metals, and other commodities, including crypto assets. However, investors should be mindful that investing through self-directed IRAs raise risks, including fraudulent schemes, high fees, and volatile performance. It is important for investors to understand these risks and take necessary steps to mitigate them before investing in a self-directed IRA.

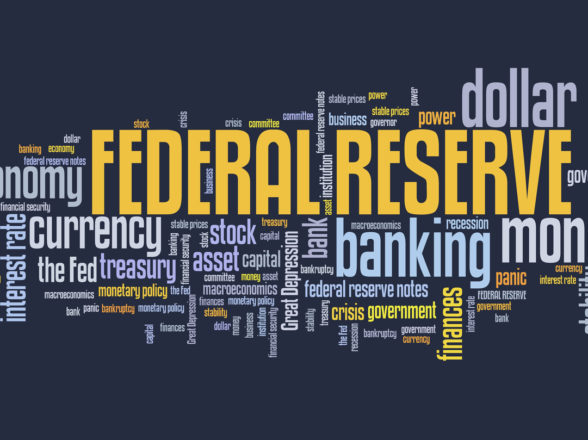

The SEC steps in

The U.S. Securities and Exchange Commission (SEC) has recently warned investors that self-directed IRAs allow them to invest in a much broader – and potentially riskier – portfolio of assets than other types of IRAs. This means that investors should be mindful of the risks that come with investing in these types of accounts, including fraudulent schemes, high fees, and lack of liquidity. Furthermore, investors are solely responsible for understanding the tax rules associated with self-directed IRAs. The SEC also warns that these investments can be more complex than traditional investments, so it is important for investors to understand the details before investing.

Buyer beware!

Investors should take extra caution when investing in self-directed IRAs and should follow certain steps to avoid any frauds associated with them. These include verifying all the information provided, avoiding unasked offers, asking questions about the investment, being wary of “guaranteed” returns and consulting a professional financial advisor before making any decisions. Following these steps can help investors protect themselves from any fraudulent activities associated with self-directed IRAs.

I got burned – now what (SEC)?

If investors find themselves victims of securities law violations, they can take recourse by reporting it to the SEC or consulting with state regulators. Additionally, there are resources available for victims of securities law violations that can help them recover their losses.

For more information visit the official notice https://www.sec.gov/investor/alerts/sdira